See This Report about San Diego Home Insurance

See This Report about San Diego Home Insurance

Blog Article

Protect Your Home and Possessions With Comprehensive Home Insurance Policy Protection

Recognizing Home Insurance Policy Insurance Coverage

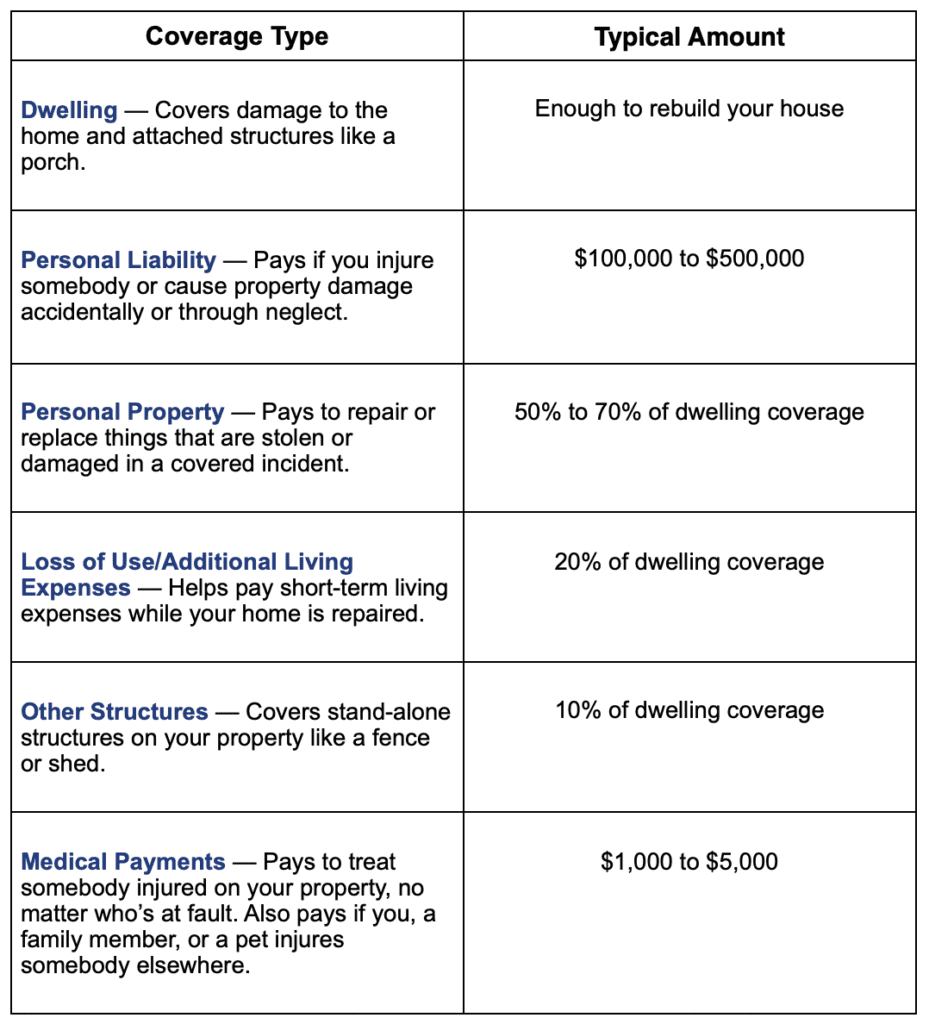

Understanding Home Insurance policy Protection is necessary for house owners to protect their residential or commercial property and properties in instance of unpredicted occasions. Home insurance policy normally covers damage to the physical structure of the house, individual valuables, responsibility security, and added living expenditures in case of a protected loss - San Diego Home Insurance. It is critical for house owners to grasp the specifics of their plan, including what is covered and excluded, plan limitations, deductibles, and any kind of extra recommendations or bikers that might be necessary based on their individual scenarios

One trick facet of understanding home insurance policy coverage is knowing the difference between real money value (ACV) and replacement price coverage. Homeowners must additionally be mindful of any protection limits, such as for high-value items like jewelry or artwork, and consider buying additional coverage if essential.

Advantages of Comprehensive Plans

When exploring home insurance policy protection, home owners can obtain a deeper admiration for the protection and tranquility of mind that comes with comprehensive plans. Comprehensive home insurance policy policies offer a large variety of benefits that go past fundamental coverage.

Additionally, thorough policies typically consist of insurance coverage for liability, providing protection in situation somebody is hurt on the home and holds the homeowner liable. Thorough policies might also provide additional living expenditures protection, which can assist pay for temporary real estate and other essential prices if the home ends up being unliveable due to a covered occasion.

Customizing Protection to Your Requirements

Customizing your home insurance coverage to line up with your details requirements and conditions ensures a efficient and customized securing approach for your property and properties. Tailoring your insurance coverage allows you to deal with the one-of-a-kind aspects of your home and properties, offering a more comprehensive shield against prospective threats. Ultimately, personalizing your home insurance coverage supplies tranquility of mind understanding that your properties are protected according to your one-of-a-kind scenario.

Securing High-Value Properties

To effectively secure high-value possessions within your home, it is crucial to evaluate their worth and consider specialized coverage choices that cater to their you can find out more one-of-a-kind worth and relevance. High-value properties such as great art, precious visit this page jewelry, vintages, and antiques may surpass the protection limits of a standard home insurance coverage. Consequently, it is essential to collaborate with your insurance coverage provider to make certain these things are adequately shielded.

One method to safeguard high-value assets is by arranging a separate policy or recommendation especially for these things. This specialized protection can supply higher coverage limitations and may additionally include extra protections such as protection for accidental damages or mystical loss.

Additionally, prior to getting protection for high-value possessions, it is advisable to have these items professionally appraised to develop their current market price. This assessment documentation can aid simplify the insurance claims process in case of a loss and guarantee that you receive the appropriate compensation to change or repair your valuable belongings. By taking these proactive steps, you can enjoy satisfaction recognizing that your high-value properties are well-protected against unanticipated conditions.

Claims Process and Policy Administration

Verdict

In conclusion, it is necessary to guarantee your home and possessions are effectively protected with extensive home insurance policy protection. By recognizing the coverage options offered, personalizing your plan to fulfill your certain demands, and guarding high-value my site possessions, you can minimize dangers and potential financial losses. Furthermore, being familiar with the insurance claims process and efficiently handling your plan can assist you browse any type of unexpected events that may develop (San Diego Home Insurance). It is essential to focus on the protection of your home and assets through thorough insurance policy protection.

One trick facet of understanding home insurance policy protection is recognizing the difference between real money value (ACV) and substitute expense protection. Property owners must also be aware of any coverage limitations, such as for high-value products like jewelry or artwork, and think about purchasing added protection if required.When discovering home insurance policy coverage, home owners can obtain a much deeper gratitude for the protection and tranquility of mind that comes with detailed plans. High-value properties such as great art, fashion jewelry, vintages, and collectibles may surpass the protection limitations of a common home insurance coverage plan.In verdict, it is necessary to guarantee your home and assets are adequately safeguarded with detailed home insurance protection.

Report this page